In the most recent June 2020 BWFA Advisor magazine, I wrote, “What a Difference 100 Years Makes…or Does It?”. In the article, I drew comparison to today’s pandemic with the Spanish Flu pandemic of 1918.

What we saw is, despite the unimaginable human suffering and death, the stock market found its bottom and subsequently moved higher. It did so in 1918 and it is doing it again now, 100 years later.

SO, WHAT ABOUT 1968?

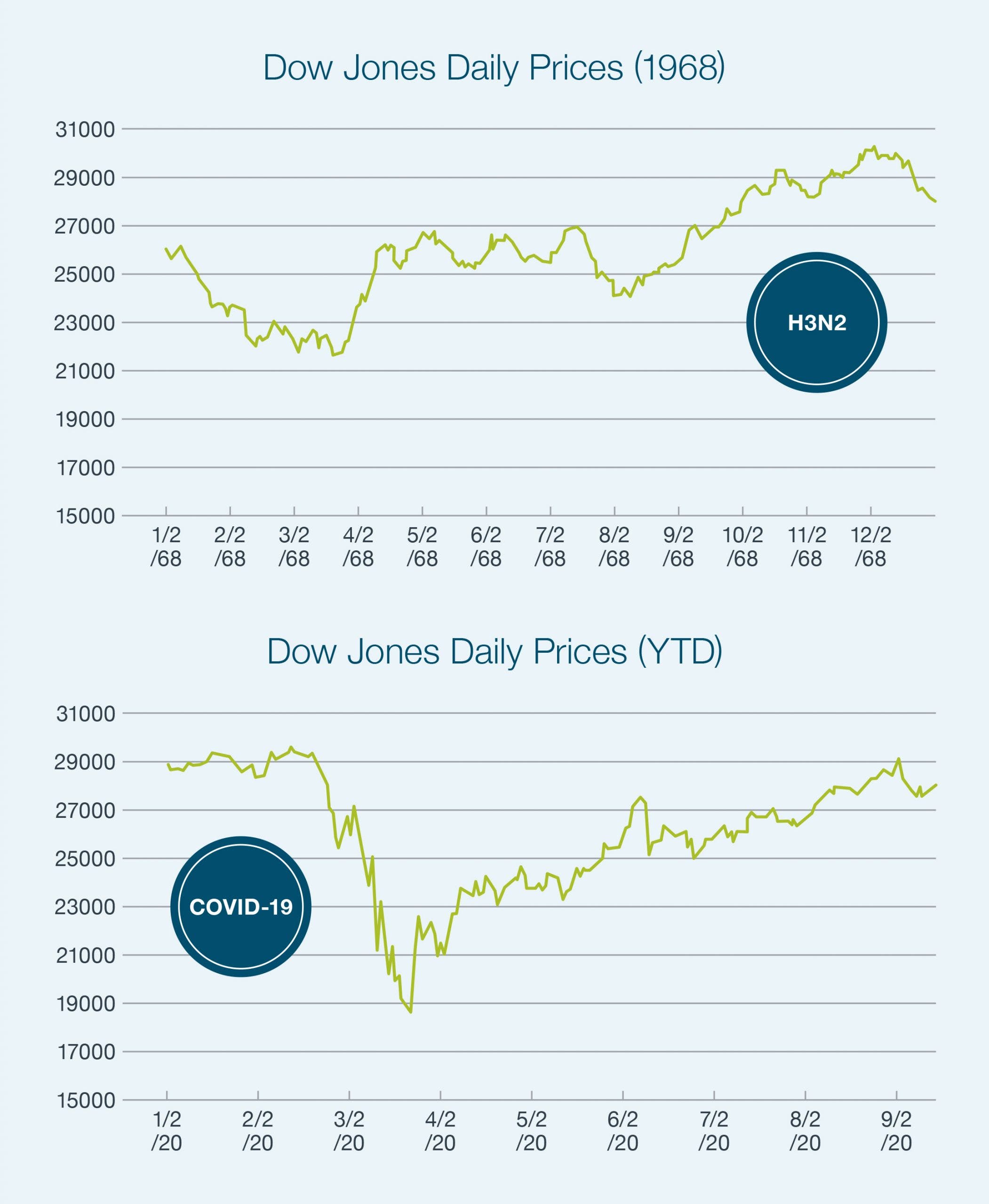

There have unfortunately been several major health pandemics in our modern history and we can see stark similarities between 1968 and today, in both health issues and overall social and societal unrest.

- Like today, in 1968, stocks did not necessarily trade on headline news—gaining, at the same time the reports show increased COVID cases and related deaths.

- Like today, in 1968, scores of US citizens died from a flu virus—the H3N2 flu which killed well over 100,000 Americans by the methods of counting at that time.

- Like today, in 1968, there was social unrest, protests, riots, and murders—most notably the assassinations of Martin Luther King Jr. and Robert F. Kennedy.

- And, like today, in 1968, the broader US stock market performed well during this time, despite it all.

The market is anticipating more uncertainty—potential additional setbacks from the health crisis and the upcoming elections—which will possibly add to additional volatility in the short run. We must keep our gaze keenly on what lies ahead in the years to come and the opportunity that presents for us as investors.

As often discussed with our clients, the stock market will anticipate what might come in the future—it is a leading economic indicator. Today, the market is anticipating a recovery in the economy despite a recent economic downturn from the nearly complete shutdown of the US economy earlier in the year. Also, the market is anticipating more uncertainty—potential additional setbacks from the health crisis and the upcoming elections—which will possibly add to additional volatility in the short run. We must keep our gaze keenly on what lies ahead in the years to come and the opportunity that presents for us as investors.

Likewise, the stock market doesn’t see the daily “scary” headlines as dangerous. These daily happenings are coupled with the longer-term US government monetary and fiscal policies. The effect of these stimulus moves seems to suggest better times ahead, based on the reaction of the stock market. Most importantly, the “scary” news we consume on a daily basis will not necessarily act as a long-term impediment to markets ability to go higher long term. If we act prudently, the long term prospects of building personal wealth remains as a reality.

At BWFA, we guide clients through the “scary times”, without seeing the danger, but rather the opportunity of investing that exists, as long term investors, to best contribute to overall financial well being.

JOSEPH MANFREDI

MBA

COO, Senior Portfolio Manager & Executive Manager

jmanfredi@bwfa.com