The 2030s may seem like the distant future and certainly not a focus for many of us looking to just make it through these challenging current times.

However, we, at BWFA, spend much of our time considering what life will look like at the end of our current decade. Our forecasting the future helps inform our investment decisions for you, our clients. So, imagining life in the next decade is a key component of our work for you.

What will life look like in 2030? Here are several perspectives on what we may expect and how these projections will influence our financial lives.

1. COVID COULD BE THIS GENERATION’S PEARL HARBOR

Ten years from now, we will look back on COVID as our generation’s “Pearl Harbor moment” — a period when extreme adversity spurs innovation and behavioral changes to help address some of the era’s biggest problems. When Pearl Harbor happened, the U.S. artillery was 75% horse-drawn. In 1941, three-quarters of our artillery depended on horses! Yet by the end of the war, we had entered the atomic age. That incredible transformation sparked a period of innovation and growth in the U.S. economy that lasted for decades.

COVID could be the trigger that spurs us to tackle critical issues over the next decade, such as the cost of health care, education, and housing. We’ve already seen an almost magically rapid development of COVID vaccines at a speed few thought possible. And we’re doing things in our daily lives we never imagined would happen this quickly.

In 2030 we may be living, working, studying, and playing in a radically new world. Our lives could be better, richer, healthier, cheaper, and profoundly more digital, virtual, and data-centric. Many of the technologies already exist, but there’s still so much untapped potential for innovative companies to think bigger and use them in ways that solve societal problems.

2. CASH IS AN ENDANGERED SPECIES

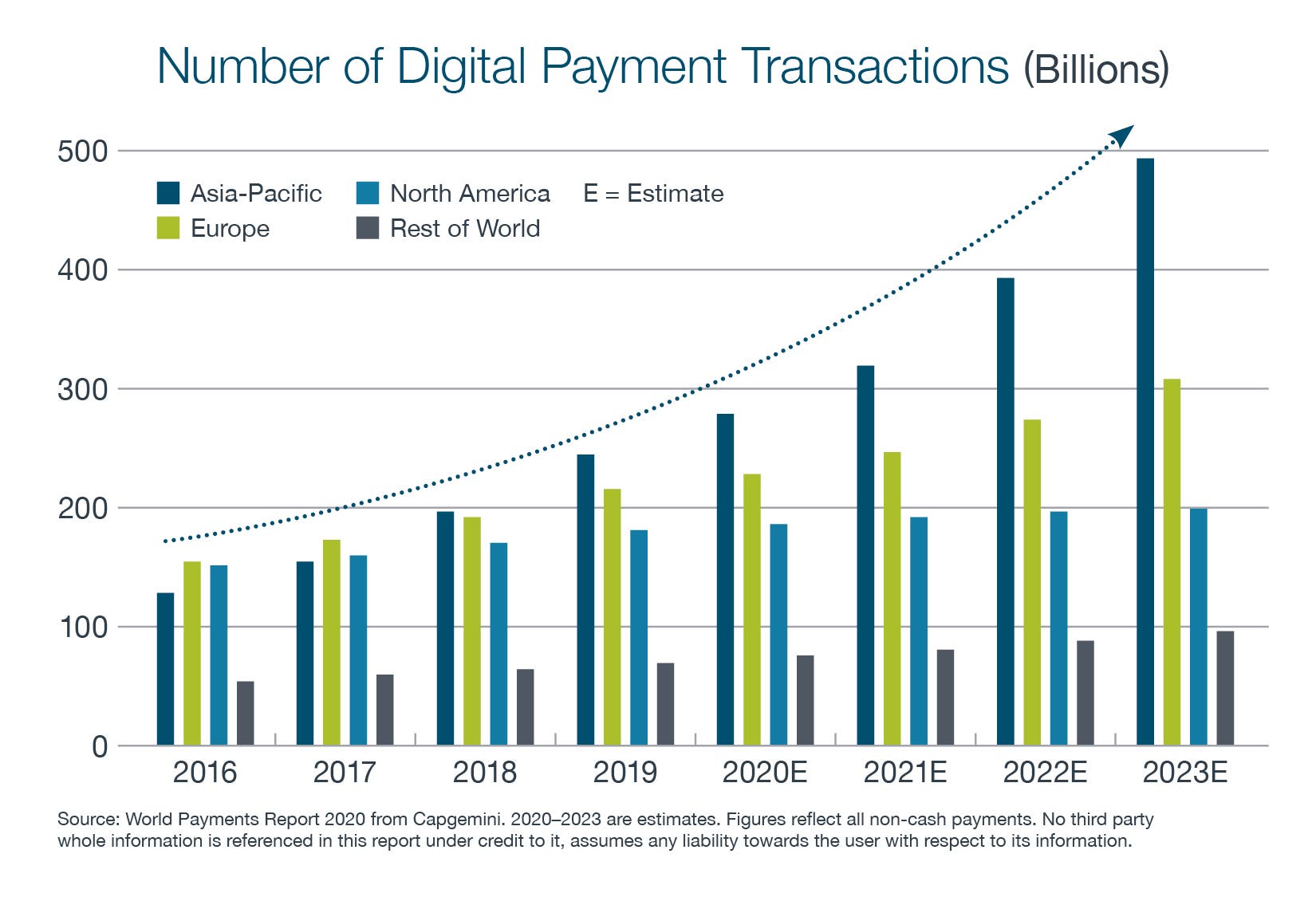

A decade from now, digital payments will be the norm, and people will give you odd looks if you try to pay with cash.

This is one area where emerging markets are ahead of the U.S. We’ve seen this trend for several years in developing countries — where many consumers had no bank accounts but did have mobile phones and adopted mobile payment technology quickly. The pandemic accelerated use of digital payments around the world, including places where it hadn’t previously been ingrained in daily life. Once this crisis is over, a lot more people will be comfortable making digital payments, and they probably won’t feel the need to use cash as much as they did before.

As consumers become increasingly comfortable with the technology, companies with large global foot-prints could be poised to benefit. We’ve also seen strong growth in smaller companies outside the U.S. that offer mobile payment platforms for merchants.

3. A CURE FOR CANCER MAY BE AROUND THE CORNER

A cure for cancer may be closer than you think. In fact, some cancers will be functionally cured with cell therapy between now and 2030. New, reliable tests should enable very early detection of cancer formation and location, thus eradicating cancer as a major cause of death through early diagnosis.

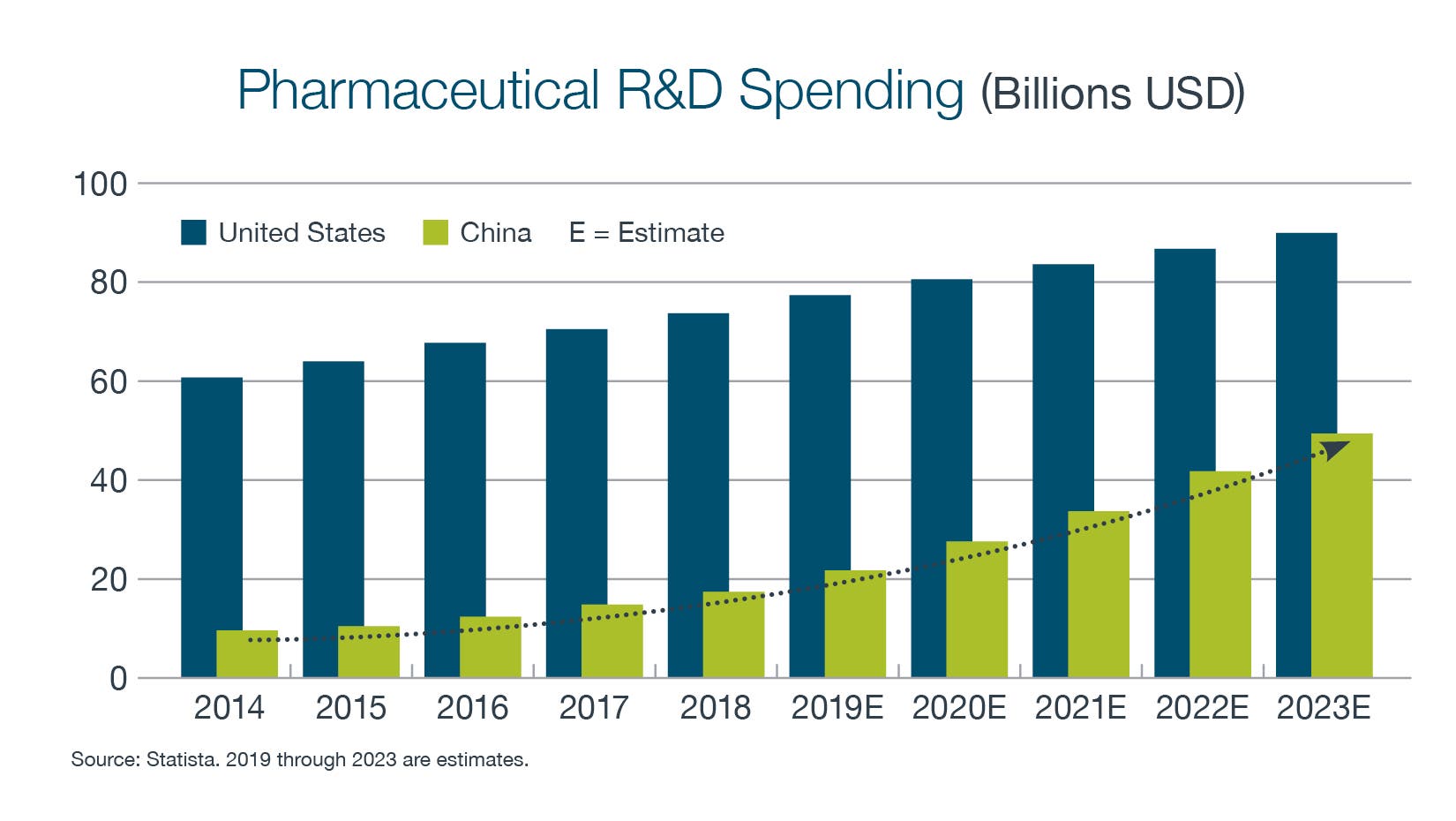

Vastly reduced costs and scientific developments have contributed to phenomenal growth in medical research. We’re in a renaissance period for R&D, and companies are investing aggressively to find unique ways to battle cancer and other illnesses. Genomics research and therapies derived from genetic testing have the potential to extend lives and generate billions of dollars in revenue for companies that develop them.

4. HEALTH CARE INNOVATION REACHES WARP SPEED

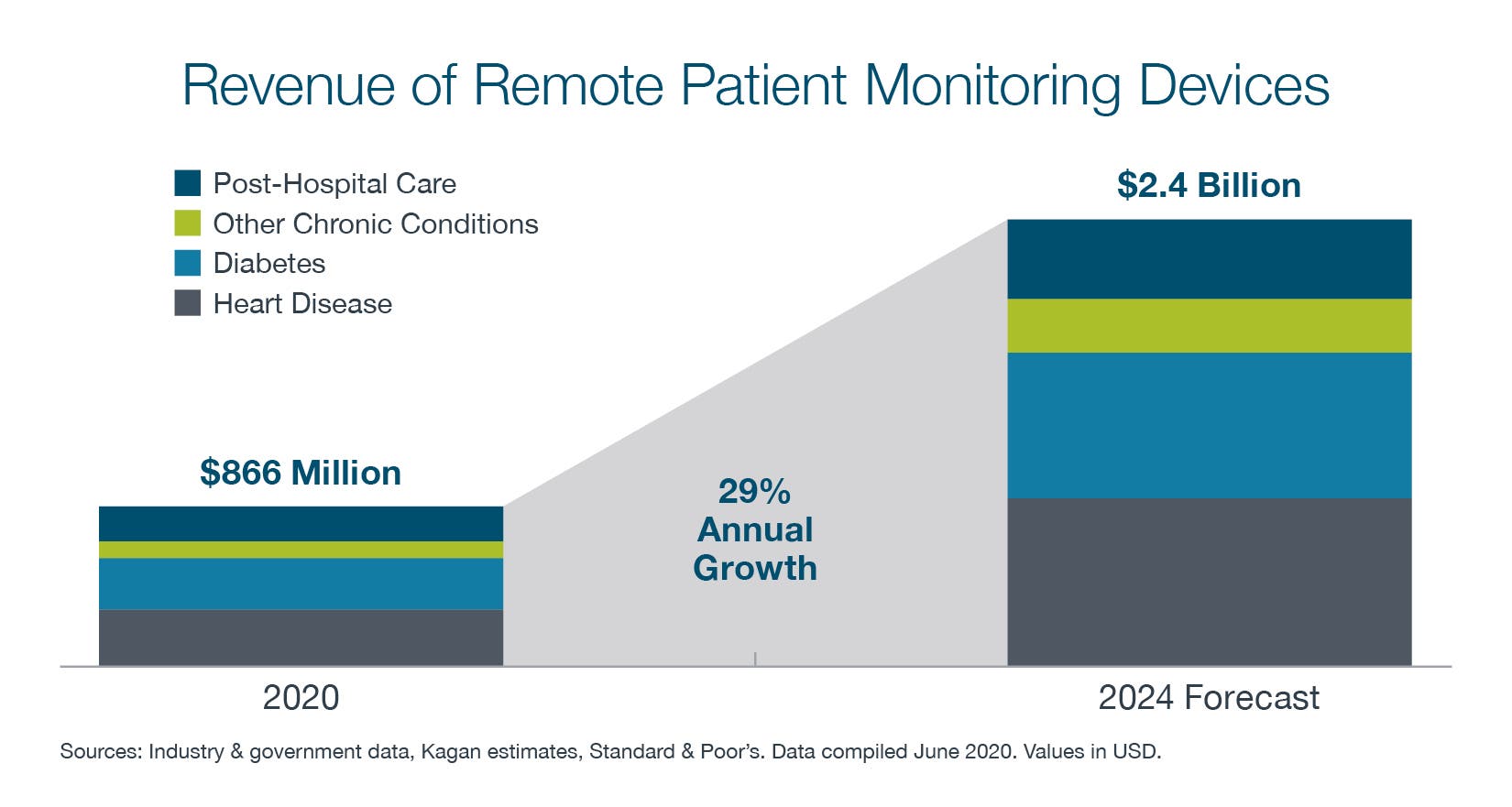

Star Trek, the classic sci-fi TV series, depicted a far-off future where space explorers traveled the galaxies equipped with cutting-edge technology such as the tricorder, a hand-held medical device that scanned a person’s vital signs, issued a diagnosis and prescribed treatment in minutes. While there may not be a single tricorder that does everything, by 2030 it is probable many of us will have devices like it that will analyze blood, do cardiology monitoring and even remotely check our breathing while we sleep, some of which are available today.

We are already experiencing a massive wave of innovation and disruption across the health care sector that has the potential to drive new opportunity for companies, reduce overall costs and, most importantly, improve outcomes for patients. Breakthroughs in diagnostics will help lead to earlier detection of illnesses, which can help make drugs more effective — or in some cases treat disease before it progresses. One of the most exciting things today is something known as liquid biopsy, whereby a sample of your blood can be used to identify a tumor at its earliest stages.

A broad range of traditional technology and medical technology companies have been working to develop home diagnostics for some time, and patients are now benefiting from their innovation. These are cost-effective devices that can collect all kinds of health-related metrics that not only help coach us to improve our own health, but can be immediately sent to our doctor for further consultation. We’re still in the early stages of development, but by 2030 it should be a routine part of our daily lives.

5. RENEWABLE ENERGY POWERS THE WORLD

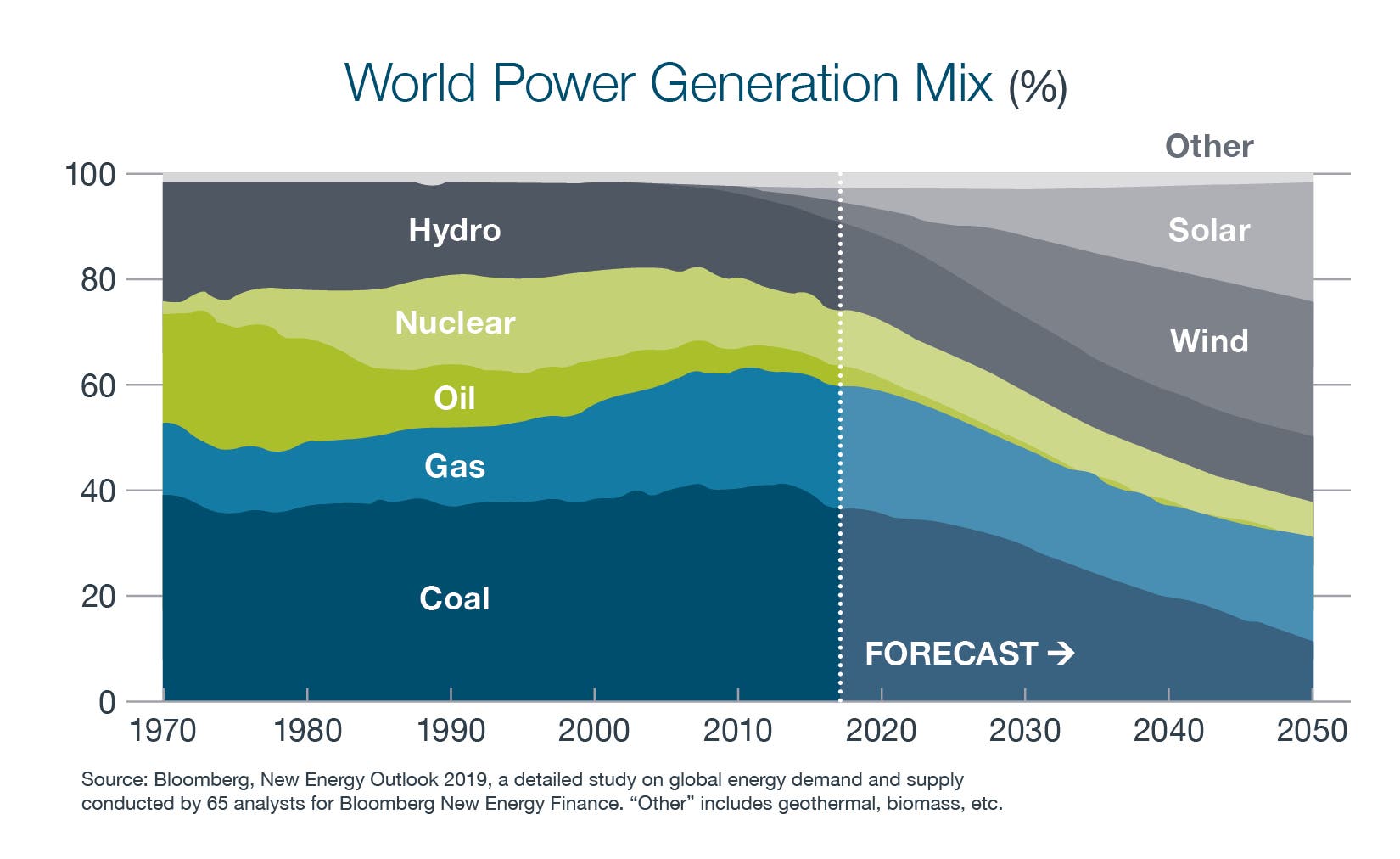

We will see a dramatic shift toward renewable energy over the next decade. We are in the early stages of the transition to an electrification of the grid and green energy, and there are strong tailwinds that could drive growth through 2030 and beyond. Automation and artificial intelligence are setting the stage for a golden age in renewables — pushing costs down while boosting productivity and efficiency.

Renewable energy has historically been perceived as expensive, impractical and unprofitable — but all that is quickly changing. Some traditional utilities are already generating more than 30% of their business from renewables and are reaching an inflection point where they are being recognized more as growth companies rather than just staid, old-economy power generators and grid operators. The move toward renewables is most pronounced in European utilities, where their governments have set high decarbonization targets. For example, the Renewable Energy Directive stipulates that a minimum of 32% of energy in the European Union should come from renewable resources by 2030.

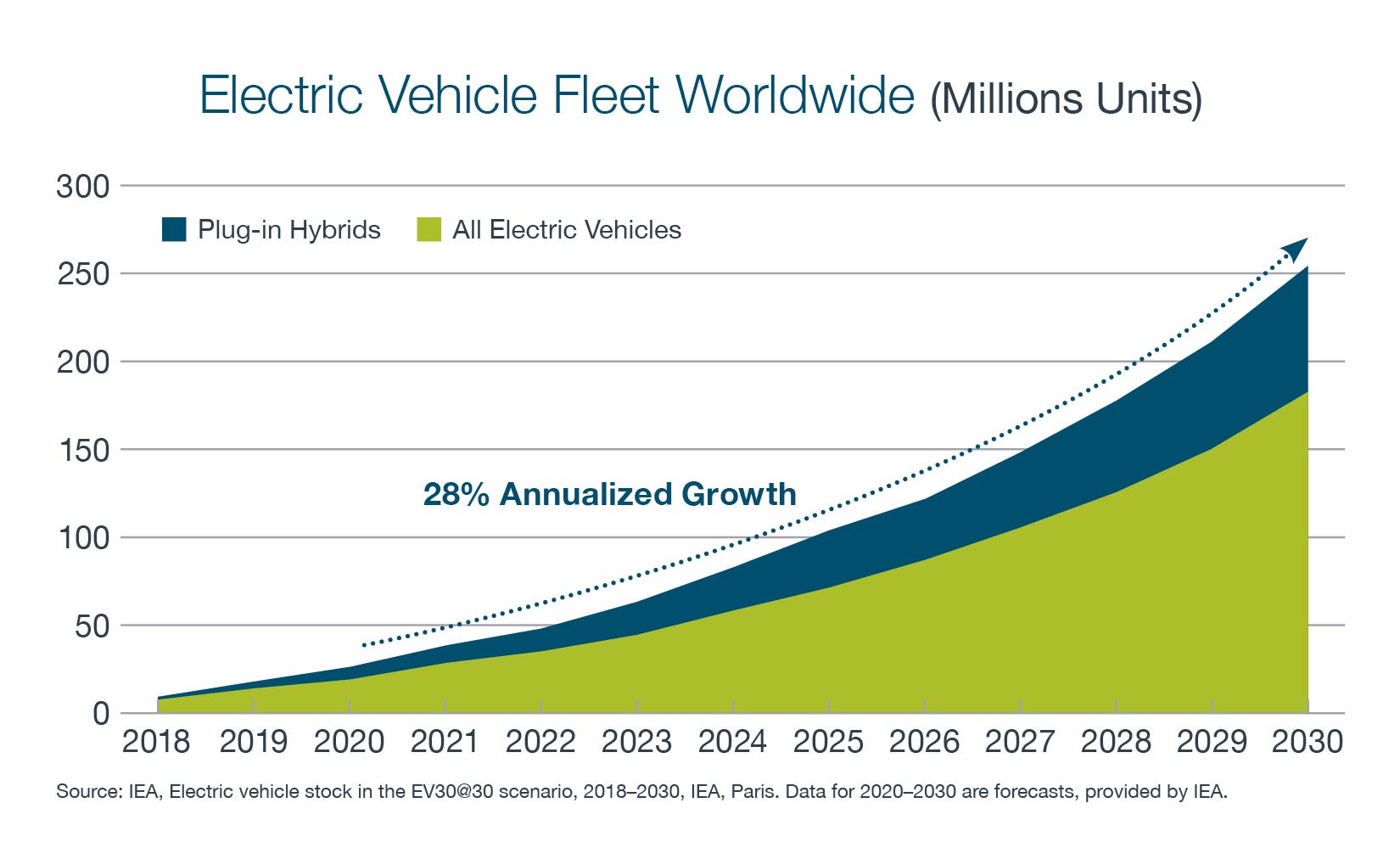

6. ELECTRIC AND AUTONOMOUS VEHICLES HIT THE FAST LANE

In 2030 we may see widely deployed fleets of autonomous electric vehicles operating in most major and many secondary cities around the world. Ownership of a personal vehicle will go from being a necessity to a luxury. Many people will still have vehicles — just like people ride horses or bicycles for fun. But personal vehicles will no longer be necessary as the primary form of transportation for most people in major cities.

This is an area that the market hasn’t fully appreciated yet. Right now, the market leaders are embedded in other companies — such as Alphabet’s Waymo, Amazon’s Zoox or the Cruise division of GM — so investors can’t buy a pure-play autonomous driving company. But as these fleets roll out more publicly, the market should start to reevaluate these companies and realize this is a real business, not a science project.

Some think 2030 is when we’re likely to see hybrid electric engines and hydrogen engines introduced into commercial aircrafts, with widespread deployment over the following 5-10 years. The impact on global emissions could be significant if we transition to a world where we’ve got huge fleets of autonomous electric vehicles on the road and aircraft transportation shifting from oil-based fuel to a mixture of oil, electricity and hydrogen.

7. WHAT’S NOT CHANGING? SUCCESSFUL INVESTING

While my colleagues and I at BWFA may look at the future and imagine new trends and products, I do predict, with a strong certainty, one constant will endure into 2030. Despite all the changes on the world’s horizon, BWFA’s focus on providing excellent service and thoughtful financial advice to our clients will persist.

BWFA will continue to research and invest, where appropriate, in companies that develop new technologies, create innovative products and move us forward into the future. Some of these companies will succeed in their endeavors and other may not. Our goal, of course, is to identify the winners as best we can. While we may sometimes miss the mark, I am optimistic that we will identify more of the winners over time and so continue to add value to our clients’ future portfolios.

ROBERT G. CARPENTER

President & CEO

rcarpenter@bwfa.com

Borrowed in part, with permission from source cited. SOURCE: © 2021 Capital Group. All rights reserved. The World in 2030: Investing for the Next Decade by Martin Romo and Jody Jonsson, February 18, 2021. Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries. Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks. Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith. Copyright © 2021 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.