Conservative Growth

OBJECTIVES

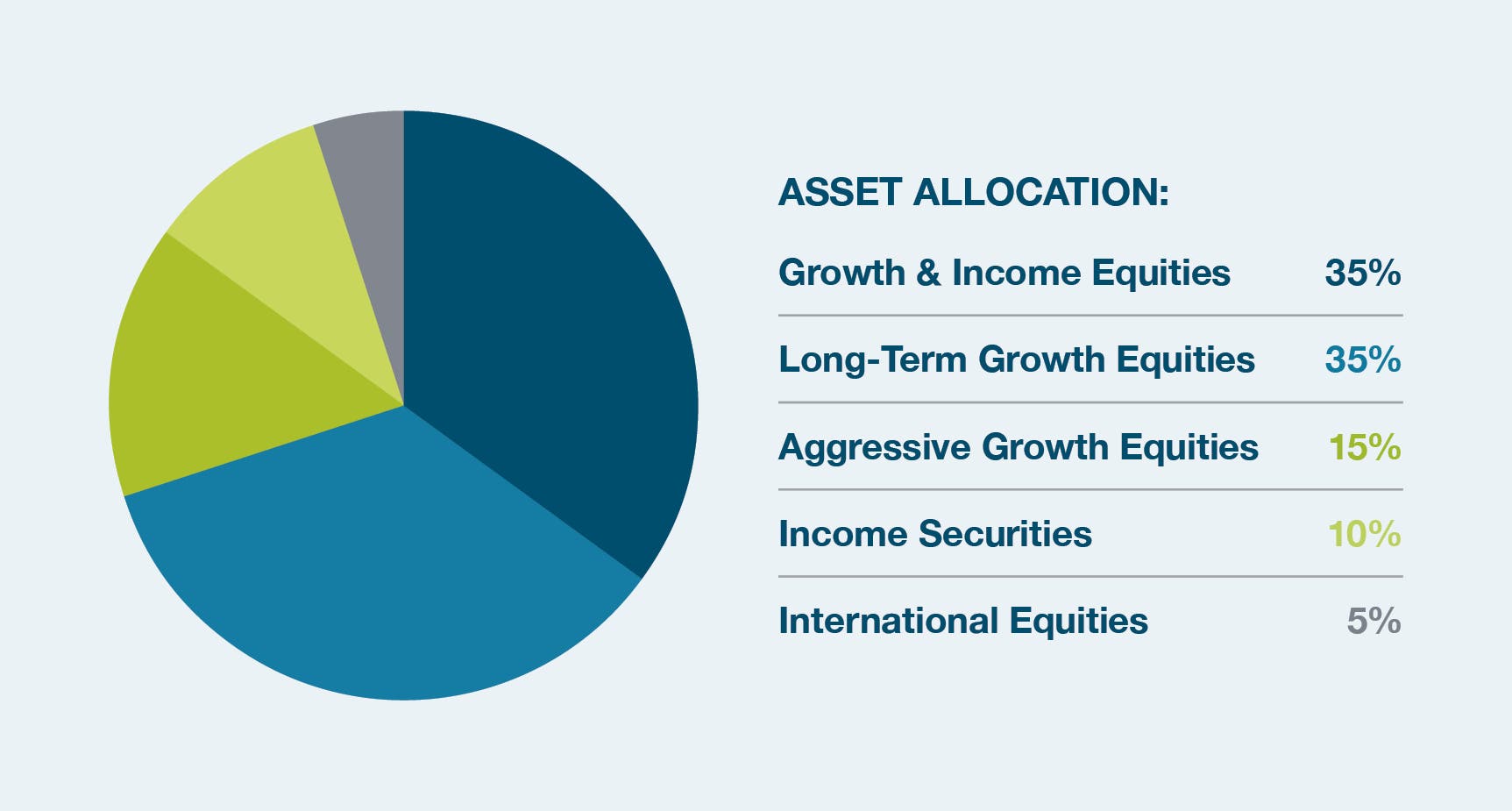

The BWFA Conservative Growth strategy seeks capital appreciation with slightly less fluctuation in value than the overall market. It also seeks a moderate level of current income.

INVESTMENT DETAILS

This strategy includes investments in various classes of equities, along with a small portion in income-producing securities to provide a “downside cushion” in declining equity markets. The emphasis on growth in this strategy orients the portfolio to stocks of companies experiencing high earnings growth, strong revenue growth, and an industry-leading position. A portion of portfolio assets is allocated toward international equities. The international investments we primarily seek represent institutions outside the United States that meet our investment criteria.

INVESTMENT STRATEGY

Our aim is to create diversified client portfolios that earn favorable investment returns while controlling volatility and risk according to the parameters of each client’s chosen investment strategy. We work to achieve strong performance over multiple market cycles, relying on the consistent application of a proven investment process. We adhere to an investment philosophy that values both vision and discipline. We do not believe that long-term goals can be met by chasing short-term results. Instead, we focus on the larger picture while remaining mindful of the current environment.

When managing clients’ portfolios with a personalized and customized approach for each client, BWFA will often exercise discretion to invest funds higher or lower than the stated category allocations in the BWFA investment strategy, within a reasonable limit, and consistent throughout the firm.