The need to outpace inflation doesn’t end at retirement; in fact, it becomes even more important. If you’re living on a fixed income, you need to make sure your investing strategy takes inflation into account. Otherwise, you may have less buying power in the later years of your retirement because your income doesn’t stretch as far.

INFLATION CUTS PURCHASING POWER

When some people say, “I’m not an investor,” it’s often because they worry about the potential for loss. It’s true that investing involves risk as well as reward. However, there’s also another type of loss to be aware of: the loss of purchasing power.

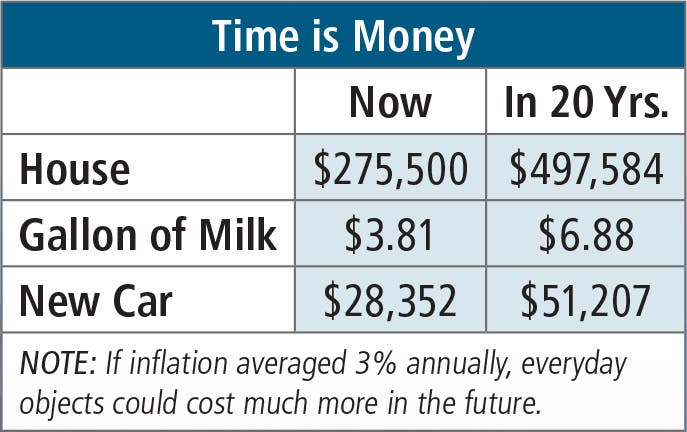

Inflation is painful enough when you experience a sharp jump in prices. However, the bigger problem with inflation is not just the immediate impact, but its effects over time. Because of inflation, each dollar you’ve saved will buy less and less as time goes on. At 3% annual inflation, something that costs $100 today would cost $181 in 20 years.

Inflation is painful enough when you experience a sharp jump in prices. However, the bigger problem with inflation is not just the immediate impact, but its effects over time. Because of inflation, each dollar you’ve saved will buy less and less as time goes on. At 3% annual inflation, something that costs $100 today would cost $181 in 20 years.

YOUR SAVINGS MAY NEED TO LAST LONGER THAN YOU THINK

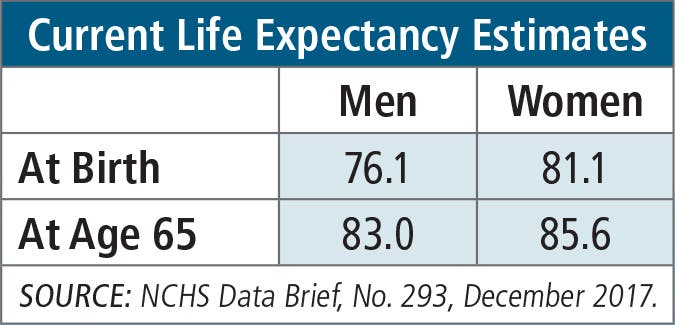

Gains in life expectancy have been dramatic. According to the National Center for Health Statistics, people today can expect to live more than 30 years longer than they did a century ago. Individuals who reached age 65 in 1950 could expect to live an average of 14 years more, to age 79; now a 65-year-old might expect to live for roughly an additional 19 years. Assuming inflation continues to increase over that time, the income you’ll need will continue to grow each year. That means we need to think carefully about how to structure your portfolio to provide an appropriate withdrawal rate for you, especially in the early years of your retirement.

ADJUSTING WITHDRAWALS FOR INFLATION

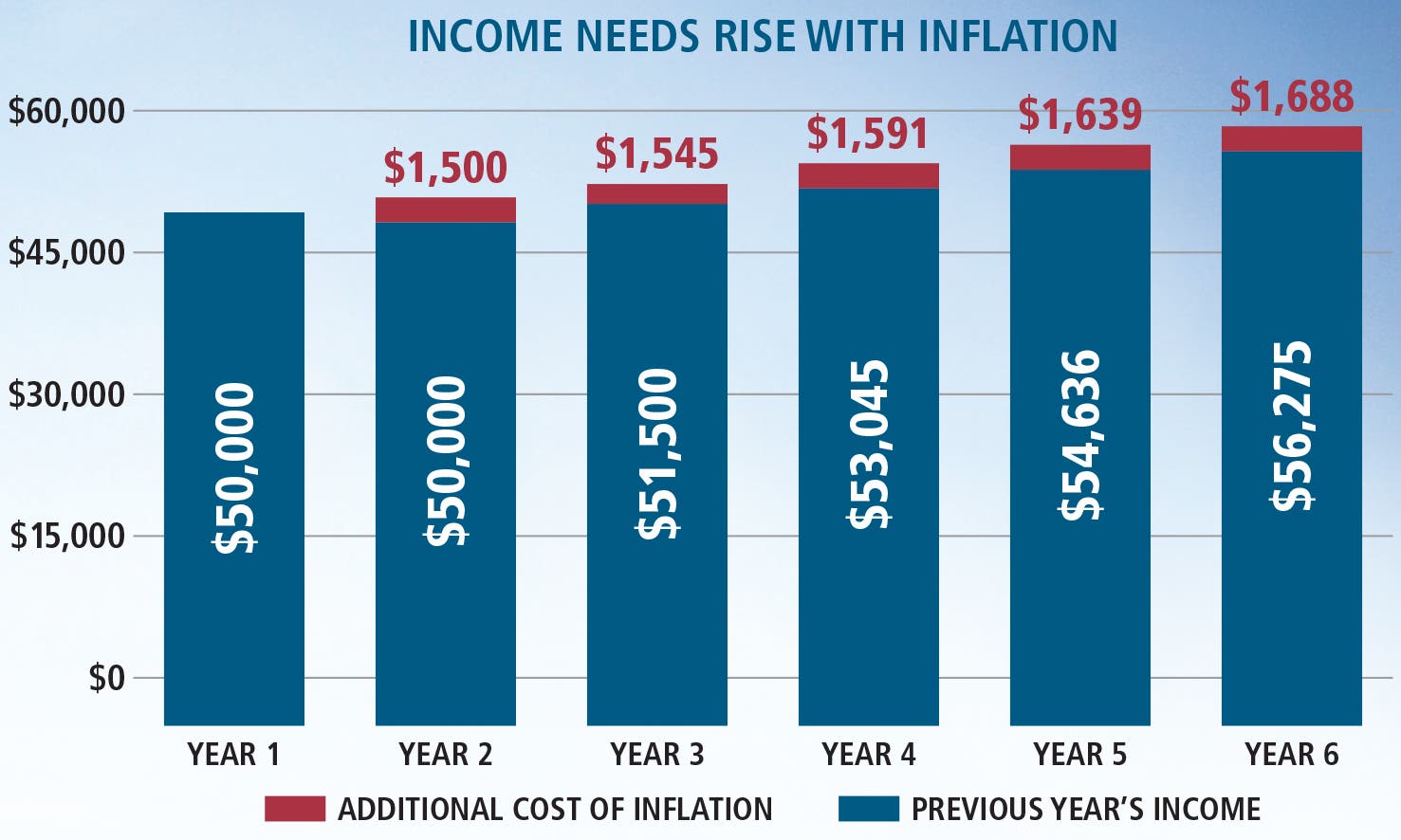

Inflation is the reason that the rate at which you take money out of your portfolio is so important. A simple example illustrates the problem. If a $1 million portfolio is invested in an account that yields 5%, it provides $50,000 of annual income. But if annual inflation runs at a 3% rate, then more income — $51,500 —would be needed the next year to preserve purchasing power. Since the account provides only $50,000 of income, $1,500 must also be withdrawn from the principal to meet retirement expenses. That principal reduction, in turn, reduces the portfolio’s ability to produce income the following year. In a straight linear model, the principal reductions accelerate, ultimately resulting in a zero portfolio balance after 25 to 27 years, depending on the timing of the withdrawals.

A seminal study on withdrawal rates for tax-deferred retirement accounts (William P. Bengen, “Determining Withdrawal Rates Using Historical Data,” Journal of Financial Planning, October 1994), using balanced portfolios of large-cap equities and bonds, found that a withdrawal rate of a bit over 4% would provide inflation-adjusted income (over historical scenarios) for at least 30 years. More recently, Bengen showed that it is possible to set a higher initial withdrawal rate (closer to 5%) during early active retirement years if withdrawals in later retirement years grow more slowly than inflation.

INVEST SOME MONEY FOR GROWTH

Before coming to BWFA, some retirees are told to put most of their investments into bonds when they retire, only to find that doing so doesn’t account for the impact of inflation. If you’re fairly certain that your planned withdrawal rate will leave you with a comfortable financial cushion and it’s unlikely you’ll spend down your entire nest egg in retirement, congratulations! However, if you want to try to help your portfolio and income at least keep up with inflation (no matter how large or small), it is worth considering a growth component made of a diversified portfolio of stocks and fixed income securities. People are living longer and the price of goods and services is rising and your portfolio needs to keep up. I encourage all of our clients to be engaged with their Portfolio Manager at each meeting so you get the retirement lifestyle you deserve.

SOME WAYS TO HELP YOUR SAVINGS LAST

Don’t overspend early in your retirement

Consider putting at least part of your portfolio in

investments that help you try to outpace inflation

Plan IRA distributions so you can preserve

tax-deferred growth as long as possible

Postpone taking Social Security benefits to

increase the amount of payments

Keep growth in your asset allocation

Robert G. Carpenter | President & CEO | rcarpenter@bwfa.com